Vehicle Tax Deduction 8 Cars You Can Get TAX FREE Section 179 YouTube

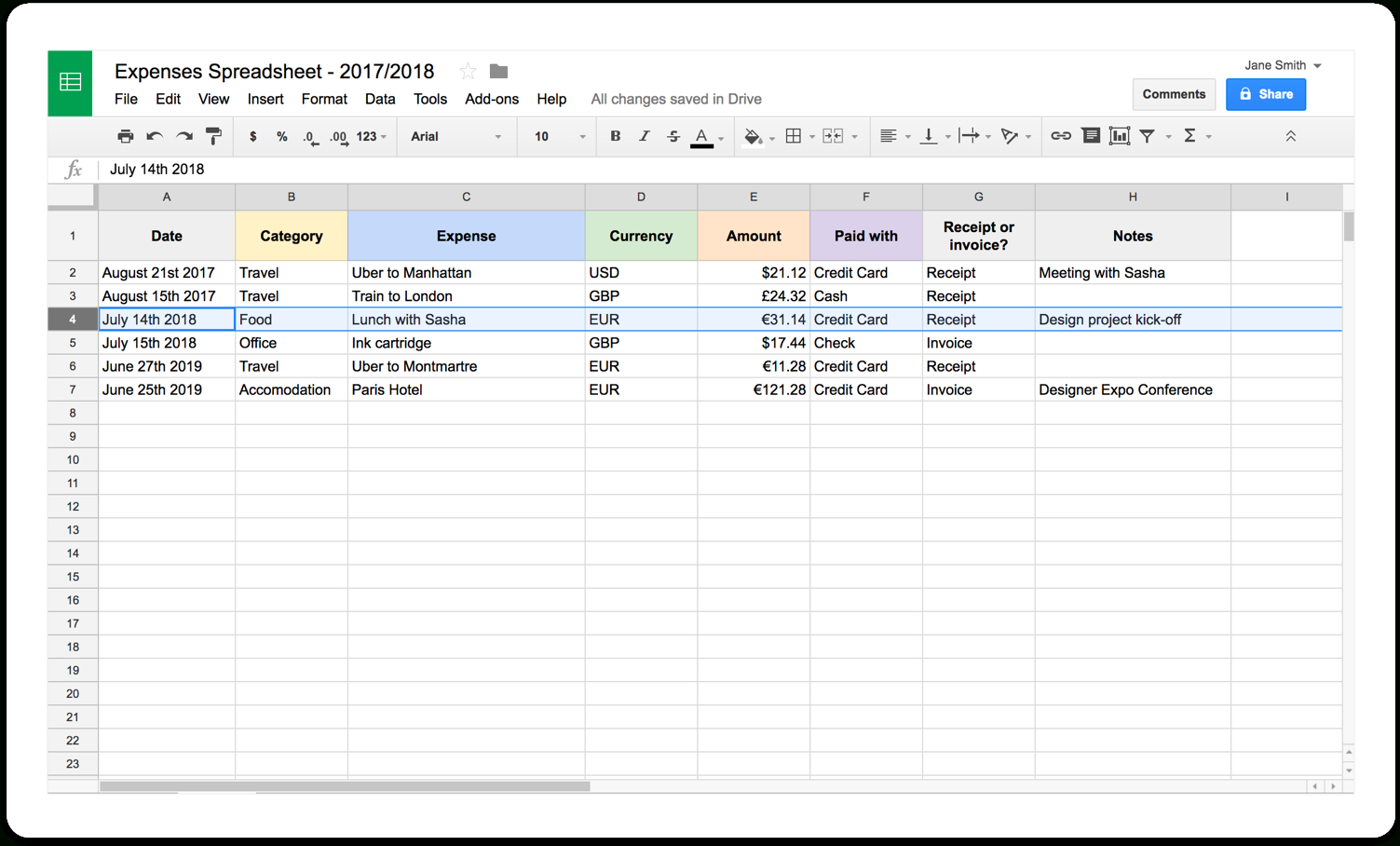

Self Employed Tax Spreadsheet —

Mileage Allowance Relief (MAR) - electric and hybrid cars are treated in the same way as petrol and diesel cars. A) Taxes applicable to all ULEV users 1. Fuel Duty. 2.1 VED is a tax applicable to all vehicles driving on UK roads. For cars first registered on or after 1 March 2001 the rate is based upon the car's CO 2.

The Ultimate Guide to Selfemployed car expenses (2022) Enterprise Made Simple

Capital Allowances: If your business purchases a new and unused electric car you get full tax relief in the year of purchase. Buy a £50,000 car, save £9,500 in corporation tax. This compares very favourably to non-electric cars which receive only 6% (£570) or 18% (£1,710) relief in year 1 depending on their CO 2 emissions.

tax incentives for electric cars uk Kami Mcallister

Yes, you can you claim capital allowances on electric cars. New and unused, electric cars bought from April 2021 can claim 100% first year allowances. Electric cars are eligible for 100% capital allowances, meaning the full cost of the car can be deducted from taxable profits in the year of purchase. This is known as the First Year Allowance.

Guide to UK Self Employed Tax for Beginners Coupon Queen

Electric and low emission cars registered on or after 1 April 2025. You will need to pay the lowest first year rate of vehicle tax (which applies to vehicles with CO2 emissions 1 to 50g/km). From.

Tax and electric cars M+A Partners

Business and self-employed;. 2016 to support the UK transition to cleaner vehicles.. to provide an increased level of tax relief for expenditure on installing new equipment for electric.

Vehicle Tax Deduction 8 Cars You Can Get TAX FREE Section 179 YouTube

What you can claim. New and unused, CO2 emissions 0g/km or less, or car is electric. First-year allowances. New and unused, CO2 emissions between 1g/km and 50g/km. Main rate allowances. Second hand, CO2 emissionsbetween 1g/km and 50g/km, or car is electric. Main rate allowances. New or second hand, CO2 emissions above 50g/km.

Decoding the New Electric Vehicle Tax Credits—How to Tell If Your Car Qualifies

:max_bytes(150000):strip_icc()/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Electric Vehicles: Update 2023. With the increased recent focus on achieving Net Zero, the government is planning to ban new petrol and diesel car sales by 2030. We review some of the tax issues that businesses and their employees may consider when acquiring or providing an electric vehicle. If you like our content come and join us.

The History of the Ford Mustang. In the early 1960s, Ford’s vice… by Charge Cars Medium

For companies and EV drivers, this is a really worthwhile electric vehicle tax benefit. As the EV driver, you're still responsible for paying the tax, but importantly, at a reduced rate (compared to petrol or diesel cars). Between 2023 and 2025, the BIK tax benefit is set at 2% and will reach 5% by 2028.

Electric cars Page 4 The Telegraph

For the 2019-20 tax year, low emission cars (classed as up to 50g/km) were taxed at 16% of the list price, or 20% for diesel cars. From April 2020 the tax charge for electric-only cars fell to 0% but for 2021/22 it increased to 1% and then further increases to 2% for 2022/23. There have also been reductions for electric hybrids, depending on.

How To Write Off Taxes On New Car Purchase Tax Relief Center in 2021 Car purchase, New cars, Car

If you're self-employed and complete a self-assessment then you add the information P11D to your tax-return. Fuel. As electricity is not classed as a fuel by HMRC, there is no benefit in kind charge for EVs. As of the 1st of March 2023 the advisory electricity rate for fully electric cars is 9 pence per mile.

blank self employed invoice template cards design templates invoice self employed invoice

The cost of domestic electricity incurred charging the company car at the employee's home is, in tax law, indistinguishable from the other running and maintenance costs (insurance, repairs etc.) and should be covered by the exemption in s239. As is widely recognised, electricity, for tax purposes, is not fuel. Following a campaign by the ICAEW.

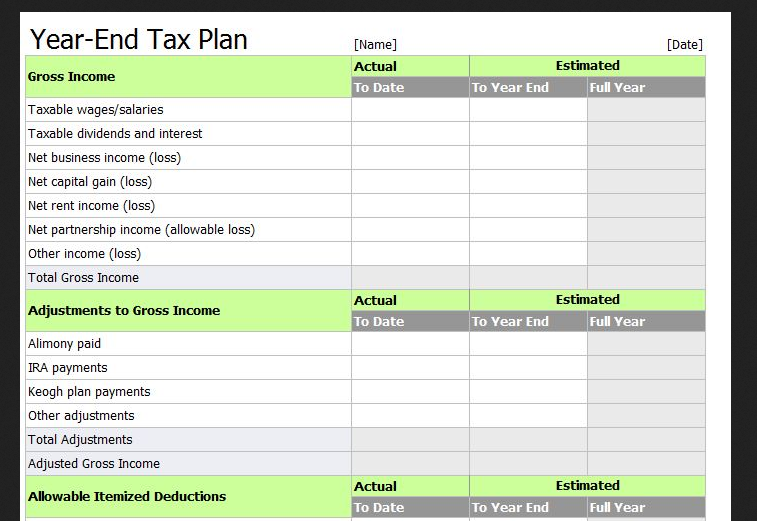

tax return spreadsheet template uk —

A battery electric vehicle (BEV) has 2% Benefit in Kind (BIK) in 2023-2024 and 2024-2025. From 1 April 2020 until 31 March 2025 all zero emission vehicles are exempt from the Vehicle Excise Duty 'expensive car supplement'. Currently all cars with a list price above £40,000 pay a supplement for five years from the second time a vehicle is.

Electric Cars Tax in 2021 l Electric Cars Tax l AccountingFirms

You can claim capital allowances on cars you buy and use in your business. This means you can deduct part of the value from your profits before you pay tax. Use writing down allowances to work out.

Electric Car Tax Credits and Rebates Charged Future

The benefit in kind tax rate for fully electric cars is much lower (2%) than for higher emission cars (from 5-37% depending on the level of emissions). The benefit in kind payment is calculated from the value of the car - so for an electric car 2% of the value is the benefit in kind and then either 20% or 40% of that figure is due as payment.

How our selfemployed workers are coping during lockdown The Canterbury Hub

The Ultimate Guide to Self-employed car expenses (2022) Nicholas. February 15, 2021. Business Development, Business Planning, Sales. When looking at the self-employed allowable expenses list, one of the main questions people have is which self-employed car expenses you can claim for. You may wonder about things like:

Working From Home Tax relief UK Claim £140 back in 5 mins! YouTube

If you are self-employed and own a car that you use for business, you have the opportunity to claim a capital allowance in the first year of ownership. Capital allowances vary depending on emissions, however, for new electric cars the allowance is 100% of the cost of the car (restricted to your business use).

.